Water Stewardship

Our basin-specific water management strategy is designed to reduce fresh water usage and operational risks. We believe it’s important to minimize the impacts of our water use on stakeholders and watersheds. We also manage risks associated with supply sourcing and produced water disposal that could potentially cause business disruptions.

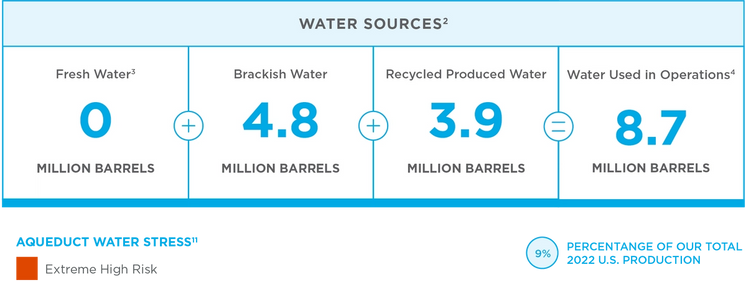

Most of our water consumption, typically more than 95%, is used in completions during hydraulic fracturing. While we seek alternative sources to fresh water, such as brackish or grey water, opportunities are area-specific and can be limited or logistically challenged.

We routinely monitor and track water use and impacts by quantity, quality (fresh, brackish, recycled) and source (groundwater, surface), which is mandated by our Environmental Management Standard and the Regulatory Compliance element of our Responsible Operations Management System (ROMS).

Each asset is also required by ROMS to conduct a risk assessment addressing local and regional sourcing constraints, capacity limitations, operational needs and disposal and infrastructure alternatives. We also participate in trade groups that share lessons learned and best practices for sustainable water management, environmental risks and technical developments.

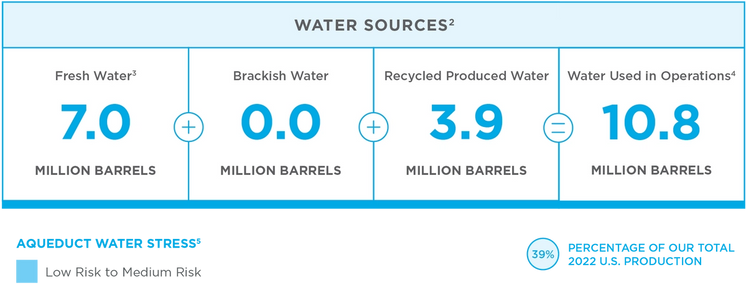

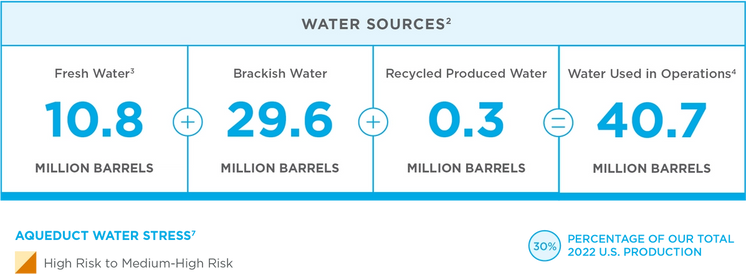

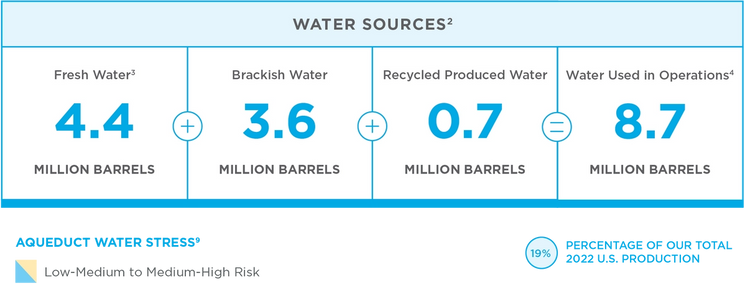

We use the water scarcity evaluation tool Aqueduct1 to align our water management with physical water stress levels and availability in the areas where we operate. Where needed, we take precautionary measures to prevent water stress impacts and employ a fit-for-purpose approach to water management in water-stressed areas.

In 2022, Marathon Oil’s U.S. fresh water use was 32% of our total U.S. water use. Of the U.S. fresh water used, according to Aqueduct’s classifications, the majority was sourced from high to medium-high stressed areas and none was sourced from extremely stressed areas.

- ᵃ Generally, water use and water withdrawal are the same except for small differences due to evaporation from company owned and operated ponds.

- ᵃ According to Aqueduct, physical water stress measures the ratio of total annual water withdrawals to total available annual renewable supply, accounting for upstream consumption. Classifications are provided in the Aqueduct tool.

- ᵃ Improved source water testing in the Permian as operations have matured post-acquisition has allowed for better classification of water quality.

- ᵇ Reduction in water consumption in 2020 and 2021 is largely due to a lower level of completion activity due to the COVID-19 pandemic.

- ᶜ Equatorial Guinea consumptive use is minimal.

- ᵃ Reduction in water consumption in 2020 and 2021 is largely due to a lower level of completion activity due to the COVID-19 pandemic.

Well Integrity

Marathon Oil takes steps to minimize the impacts of hydraulic fracturing through proper well construction, fresh water conservation, air emissions reductions and responsible waste management.

To support well integrity, we follow industry best practices, internal procedures and applicable laws and regulations for proper well construction. We also conduct pre-drill sampling to evaluate the baseline quality of water sources located within a quarter mile of drill sites, select appropriate construction materials, comply with state rules for drilling and completions, utilize production safeguards, and test and monitor hydraulic fracturing during operations.

We publicly disclose hydraulic fracturing data for 100% of unconventional wells drilled and hydraulically fractured in North America in FracFocus, a voluntary online chemical registry. Toxicity is addressed in a Management of Change review conducted for any new chemical we are considering using. The Management of Change review, performed by qualified employees at all U.S. production operations, includes assessing reactivity, corrosivity and potential harmful effects. In addition, exclusive of firefighting chemicals and materials containing Teflon (e.g., seals and gaskets), we don’t use any fluorinated-based chemicals (PFAS/PFOA) in our operations.

For additional details, read our Hydraulic Fracturing Overview, as well as the Managing Produced Water section, the Spill Prevention and Response section, the Materials Management section and the Safety and Workforce section.

Produced Water Skids

In our Bakken operations, the asset team came up with a creative and proactive environmental approach to produced water recycling in the form of portable produced water skid units. These skids can be conveniently moved from pad to pad and tied into the existing water gathering system where available. Produced water can be easily pulled from the existing produced water collection pipelines and reused during hydraulic fracturing — all while maintaining existing pipeline safety controls. In 2022, the Bakken team moved more than 1 million barrels of produced water through these roving skids. In all, ~35% of all flowback water was recycled in the Bakken using various technologies including the new skid system.

Managing Produced Water

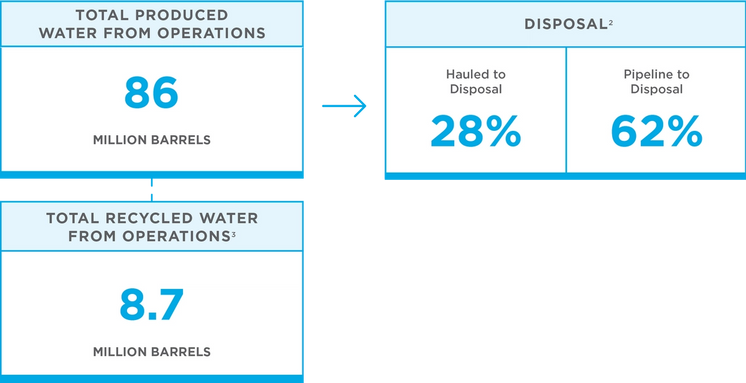

To protect surface and groundwater resources and natural habitat, we have procedures that help us manage and dispose of our produced water in accordance with federal, state and local regulations. The Responsible Operations Management System (ROMS) mandates that produced water disposition is tracked by volume, transport and disposal method. Produced water in our U.S. onshore operations is either recycled for use in the oilfield or disposed of via saltwater disposal wells. Our ability to recycle produced water is highly dependent on proximity between supply and demand, local constraints/regulations, continuity of acreage position and spill risk management.

In the United States, we do not discharge treated, produced water to surface; thus, our total wastewater discharge in the United States is zero.

See our Five-Year Performance table for global information. Our international discharge comprises 0.13 million barrels from our Equatorial Guinea operations (primarily our offshore platforms) and is treated to appropriate international guidelines and regulations. Pass-through, non-contact cooling water is not included in discharge values.

Marathon Oil transports much of our produced water via pipeline (i.e., low-carbon transportation) by utilizing a combination of midstream water-handling providers and company-owned and operated infrastructure. In 2022, approximately 62% of produced water in our U.S. operations was disposed of using pipelines, eliminating approximately 465,000 truckloads and associated emissions of 30,000 MT of CO2 and leading to improved road safety.

U.S. Operations Produced Water Performance¹

Water Usage by Resource Play

We take a thoughtful approach to managing water sourcing, recycling, treatment, storage and disposal infrastructure across our assets.

Bakken1

Eagle Ford6

Oklahoma8

Permian¹⁰

How are we doing?

Your opinion matters. Please take a moment to let us know how useful you find the content on this page.

If you’d like to give us your feedback on the entire report, please fill out the complete survey for the 2022 report.