Climate Change: Governance and Strategy

Governance

The board has ultimate responsibility for risk management, and its decision-making takes climate-related risks into account. The charter of the Health, Environmental, Safety and Corporate Responsibility (HES&CR) Committee of the board of directors includes climate change risk oversight, demonstrating our commitment to a robust understanding and evaluation of climate risk. This committee meets at least twice per year to understand and monitor climate-related trends, issues, legislation, policies, practices and concerns, including performance against our stated emissions reduction objectives.

Our executive vice president of Operations, who reports directly to the CEO, has leadership responsibility for climate-related issues and provides regular updates to the board regarding performance. Our vice president of Health, Environment, Safety and Security (HES&S) and Corporate Sustainability, who reports to the executive vice president of Operations, has leadership accountability for driving our corporate sustainability programs. This role provides the strategic focus necessary to align all areas of our corporate ESG strategy and embed sustainability practices into the way we run our business.

Strategy: Identifying and Managing Risks

Our Enterprise Risk Management (ERM) and Responsible Operations Management System (ROMS) processes are the primary internal assessment tools we use to identify and communicate climate-related risk.

We use the ERM process to identify and manage the most significant risks facing the company, with the goals of facilitating risk oversight by the board, managing enterprise risks and ensuring accountability for risk management. Internal risk assessors present ERM process outcomes related to climate risk to the HES&CR and Audit and Finance committees to inform the board’s oversight responsibilities.

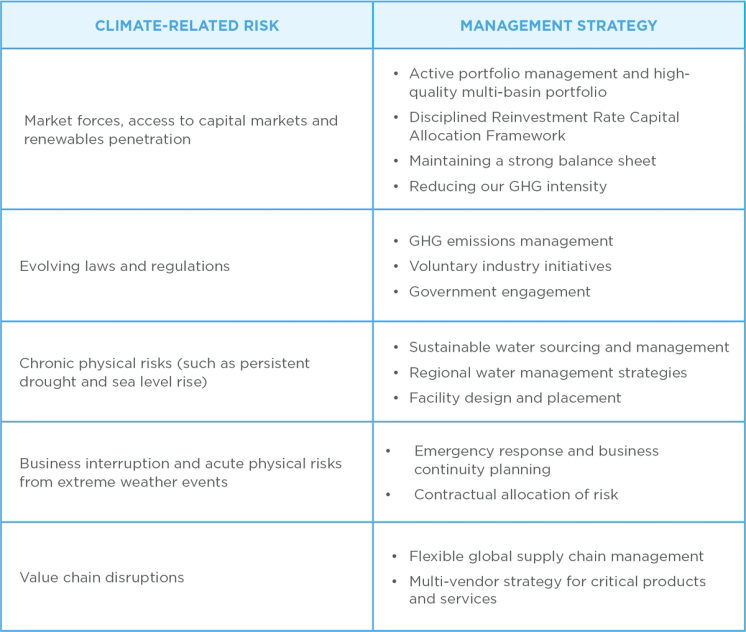

Through our ERM process, our board and management examine a wide range of strategic, reputational, operational and financial risks that could impact the company. The primary potential climate-related risks identified through the ERM process are:

- Market forces that could affect commodity prices, including renewables uptake and pace of energy transition.

- Access to capital markets.

- Evolving U.S. federal and state and global climate change policies, laws and regulations.

- Chronic physical risks (such as persistent drought and sea level rise).

Business interruption and acute physical risks from extreme weather events. - Value chain disruption.

We continue to evaluate and enhance our risk assessment processes to provide company leaders with the information they need to manage climate risk.

Our corporate HES&S group monitors a number of key environmental performance indicators. Operational leaders identify, assess and manage GHG emissions and other aspects of climate change risk using ROMS. The ROMS executive steering team and owners of relevant ROMS elements are then accountable for driving performance improvement, including managing climate change risk. For more information, see the Sustainability Management section.

Strategy to Mitigate Our Risks

We evaluate our business model by applying our risk assessment tools and measuring alignment with our governance models, and we monitor and take proactive steps to mitigate risks to our business strategy related to climate change.

We have operationalized key environmental performance indicators that are used to drive asset performance improvements. In addition, we monitor regulatory changes and risks through our trade organizations and government relations professionals, which allows us to adjust business plans and operations to mitigate risks.

How are we doing?

Your opinion matters. Please take a moment to let us know how useful you find the content on this page.

If you’d like to give us your feedback on the entire report, please fill out the complete survey for the 2022 report.